I don’t know about you, but July feels like a “calm before the storm” for our family. Here in Metro Atlanta, August 1st is the first day of school, and even though I homeschool my kids, we follow our local school calendar so my kids can have school breaks alongside their friends.

But July is also the year’s halfway point—it’s the perfect time to reevaluate our goals and see our progress.

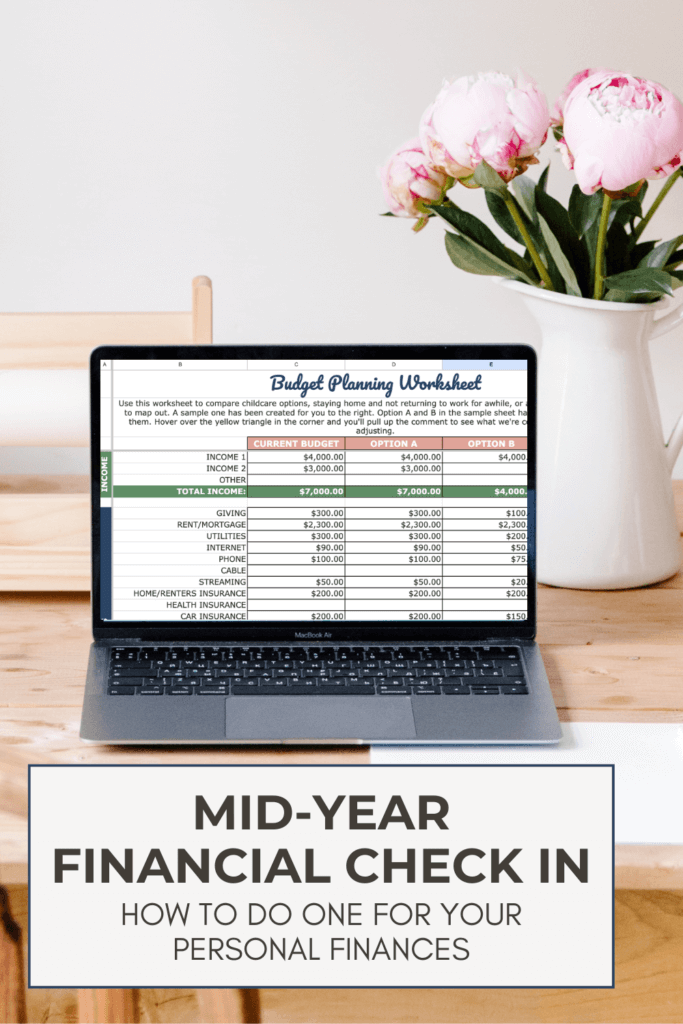

So, if you haven’t already done a mid-year check-in with your finances, today is the day to do it! We have to make sure that we’ve got a game plan put together for the remaining six months of the year so we can achieve those financial goals that we’ve set for ourselves.

Are you on track to save for Christmas? 🎄

Christmas will be here before we know it. And if you’ve found yourself in Christmases past sinking further into debt and beginning the New Year off deeper in the hole – you need to set up a Christmas Sinking Fund ASAP. Then, you need to set up an auto draft of $20 every week towards your Christmas Sinking Fund. This will give you CASH money to buy Christmas presents with this year. That means you won’t be starting off the New Year deeper in debt!

Are you prepared for Back-to-School shopping? 🎒

Regardless of when the new school year starts for your family, it’s around the corner! And we need to be prepared for it. For our family, we have, you guessed it, a Sinking Fund where we save up money for our children’s school supplies, clothing, and sports/extracurriculars. This keeps us from overspending and keeps us from looking up and realizing that our son’s baseball cleats that fit fine last season are suddenly two sizes too small. We have the money ready to go without having to fret over it.

Also, if you haven’t checked already, several states offer Sales Tax Holidays before the start of the school year. Head here to this website to see if/when your state has one.

Have you completed your Financial Snapshot from earlier this year? 💻

If you’re one of my previous coaching clients, you’re familiar with the Financial Snapshot because I make all my clients complete one before we can work together. The reason for this is that I can’t help you if I don’t know what your starting point is. And that’s the whole point of a Financial Snapshot – to see your overall current financial reality. This blog post here goes into more depth on setting up your Financial Snapshot. And if you’d like a spreadsheet to help you, I’ve got one in my shop for $1 here. The Financial Snapshot is essential to helping you figure out your starting point and map out how to achieve your financial goals – so don’t sleep on this important tool!

Do you have any summer travel plans left on the calendar? 🏖

If so, let’s make sure we’re prepared for those! Do you have a Vacation Sinking Fund? If not, I highly suggest you set one up so you can include summer vacation savings as part of your normal regular budgeting routine. That way, you’ll always have cash on hand to pay for vacations! Even if you like to use credit cards to book vacations that Sinking Fund can make sure you have the cash to pay off that bill when you return home. No one likes to come home from vacation further in debt.

Have you checked your credit report this year? 📈

If not, now is a great time to do it! You can pull your credit report for free from all three Bureaus once a year by going to annualcreditreport.com. Then, go through each report and look for any errors. Make sure to report those to the reporting Bureau. I use Credit Karma to monitor my and my husband’s credit for free. You seriously don’t have to pay for credit monitoring if you don’t want to. But if you don’t currently monitor your credit, I highly recommend that you start. Even though my family is 100% debt-free and we don’t use credit cards, it’s important to know what’s on our reports and to monitor our credit. After all, utilities and other bills will pull your credit when setting you up with a new service. You want to make sure that everything is golden.

Alright, friend! We’ve got this! We’re going to finish off this year well, and we’re going to make some great progress on our financial goals! 💪

Leave a Reply