Recently on Instagram, I asked what my follower’s number one financial concern was. And an overwhelming majority said “saving money.” Which, to be honest, surprised me. I figured “food costs” or “childcare expenses” would be higher. Saving money is and has always been a challenge for my family. As I said in my book, saving money is harder than paying off debt. When you’re paying off debt, there’s a real threat if you don’t pay the bill – water gets shut off, and your car gets repoed. But if you fail to save money, the only one who suffers is you. No one is going to show up at your door demanding you move money from your checking to your savings. So here are 20 ways to stretch your income and save money.

1. Ask Your Employer for a Raise

I know this one seems scary, but if it’s been a while since you last got a raise, it may be time to ask for you to ask for a raise. The cost of living has risen dramatically since the Pandemic and soaring inflation. And if your income hasn’t kept up, make a plan to sit down and talk with your boss about a potential raise. The worse that can happen is that they tell you no. But the best that can happen is you’ll get a raise.

Another way to get a “raise” that doesn’t involve asking your employer directly is to check your tax withholdings. If you get a large refund every year then you are probably withholding too much from your paycheck. That’s money that you could be using all year long! Head here to use the IRS calculator to see how much you should withhold. Then update your W-4 with HR.

2. Side Hustle

If you ask for a raise and get turned down, it may be time to pull a side hustle. Here’s the deal. If you’re struggling to save money, you’re living without a safety net. And anytime anything pops up, it’s going to threaten to drown you financially. To prevent that from happening, you NEED an Emergency Fund. Period. You need it. And one of the fastest ways to build up an Emergency Fund is to pull a side hustle and put all that extra income into your Emergency Fund.

Possible side hustle ideas:

- Doing laundry for others (look into sudshare.com).

- Selling your landscape photography for stock photos.

- Freelance (writing, accounting, tutoring, editing, design, etc.)

- Dog walking or pet sitting.

- Lawn care

- VA services

- Drive for a rideshare service.

- Deliver food or groceries.

- Offer classes on Outschool

- Rent your home or spare bedroom on Airbnb.

- Clean houses

- Babysit

- Offer music or singing lessons if you’re musically talented

- Wash and detail cars

- Deliver Amazon packages

Here’s the thing. You don’t have to do everything on the list, and you certainly don’t need to do the side hustle for forever. I recommend you set a savings goal. Say $5,000. Once you hit that goal, you quit the side hustle. I don’t believe in living a life of hustle, but I do believe that some seasons of life require it.

3. Buy Used

It’s time to think about what we need in our lives differently. It’s time to buy used! Consignment stores are a dime a dozen, and there’s my personal favorite, ThredUp. You don’t need to buy brand-new clothes. You and your family will be fine wearing previously owned clothing.

Same with cars. Yes, I know you’re going to freak out about this, but you don’t have to buy a new car. I know that it’s true that some used cars are crap, but the reality is there are plenty of used cars out there that are amazing. Not only that, if your current car needs some love and even some repair, do it. Don’t go out and buy a new $30,000 car just because your current one needs $2,000 in repairs. That doesn’t make any sense. Save your money.

4. Cash Back

I know some folks love their credit cards, but I’m not talking about earning cash back via credit cards here. I’m talking about using sites like Rakuten when you shop online. You earn real cash back that gets deposited into your PayPal account. Then you can move that money straight into your savings account!

There are also Swagbucks, where you can earn SBs on your purchases. You can cash out these SBs for gift cards or cash via PayPal. The same principle applies here. Use the cashback to increase your Emergency Fund quickly.

The point here is to stop thinking about cashback as “free” money. Instead, think about it as icing on the cake to achieving your big goals. An extra $5 in cashback here or there can really start to add up as long as you take action with it.

5. Paid Subscriptions

When was the last time you reviewed your spending? I mean really dug deep and reviewed it? Chances are there is probably a subscription or two that you’ve forgotten about that you’re still paying for. Or maybe there’s a subscription that you keep hitting “skip” on instead of just canceling it. Well, guess what? It’s time to cancel these services.

Here’s what you’re going to do:

Pull the last 30 days’ bank statements for every account you spend money from (checking, credit cards, etc.). Then using different color highlighters or markers (or colored pencils), “highlight” like transactions. So all groceries highlight in yellow. All transportation expenses highlight in green. All utilities highlight in purple. And so on and so on.

Then tally up all the same colored highlighted transactions. It’s okay if you have a bunch of transactions that you don’t remember what they were for. Pick a color to highlight as “miscellaneous”. Now looking at these transactions, what subscription services can go? Do you watch Hulu that often to justify spending that money every month? Even if you’re only paying $7.99 a month for it, you’re spending $80 a year on something you don’t use. You could instead start an automated transfer of that $7.99 to your Emergency Fund and effortlessly add $80 this year to your savings account. Keep going through those subscriptions. I bet you’ll find even more you could go without. Take that money and stick it into your savings account instead.

But, and this is a really BIG but. You must do something with the money you’re saving. If you cancel all these subscriptions but don’t transfer the money you were paying for them to your Emergency Fund, it’s not helping you save. To make saving money a habit and make it easier you need to set up an auto draft of the amount of money you’re saving by canceling these services. Otherwise, the money will slip right through your fingers.

6. Frugal Travel

Right now, I’m writing this slap dab in the middle of summer. I know that summer travel is on most families’ minds during this time of year. But regardless of where you travel, I firmly believe that you don’t have to spend a fortune to have an amazing vacation. And you certainly don’t have to go into debt to have a great time, either! So if you’re wondering how you can make taking vacations and saving money a reality for your family here’s how!

First, you need to set up a Vacation Sinking Fund. This will allow you to save all year for a family vacation you can afford to take in cash. So no sinking further into debt. Next, you need to change your mindset around travel. You don’t have to stay in a beachfront condo. You could instead stay ten minutes inland for a cheaper rate. Same with eating out. You don’t have to eat out every meal. Go grocery shopping and cook most of your meals instead of spending $50 + a night on takeout.

Here’s the deal. The less you spend on travel, the more money you’ll have to set aside in your Emergency Fund later. And if you want to see how my family of five managed to travel to the beach on a $1,000 budget for years, head to this post here.

7. Don’t Be Afraid to Ask for Help

Let’s get real. Life ain’t cheap. And if you’re struggling to put food on the table or keep the roof over your head, do not be afraid to ask for help. There is no shame in asking for help when you need it. Check to see if you qualify for WIC. Research local food pantries, or if you have children in diapers (WIC, unfortunately, doesn’t cover diapers), reach out to crisis pregnancy centers in your area. Many of those centers will either have diapers available or can direct you to organizations that can help you.

If you have family or friends willing to help, reach out to them. Reach out to your church – many churches are willing to help you. We have to stop expecting help to find us. Sometimes we have to be willing to go out and seek it. “Until now, you have not asked anything in my name; ask, and you will receive so that your joy may be complete.” John 16:24 It’s okay to ask for help. Don’t lie to yourself that no one is willing to help. Yes, it may be true that you need to dig deeper or look longer for help, but it’s there. Don’t give up.

8. Spending Less on Essentials

After you’ve done a spending review, you may find that you need to cut back on your expenses even on the essentials. It’s not always easy to cut back on groceries or utilities, but it is possible. First, contact your utility providers and ask about flat rates or discounts. Start looking around at other utility providers if that doesn’t lead you anywhere. You may be able to find a better deal by switching companies.

Same with insurance. You need insurance, but that doesn’t mean it needs to cost you an arm and a leg. Call around and get quotes. It doesn’t take that much time, and heck, you can do a lot of it online without even having to speak to anyone!

Groceries will be a little harder to bring down, but again, it’s not impossible. You can lower your grocery budget for the long term by taking an actual inventory of what you already have in your pantry, freezer, and refrigerator. If you have a deep freezer or garage fridge, take inventory there too. Then start thinking of the meals you could create using those ingredients you already have on hand. Then add to your grocery list any missing ingredients. And stick to your grocery list! Don’t be tempted to buy more simply because your cart doesn’t look as full as usual (that’s why you take the inventory so you can tell your brain not to freak out). Challenge yourself to first “shop” what you have at home before heading out to the store. This will help you determine your true needs and what you stretch.

9. Bring Your Lunch

Yes, I went there. You don’t need to eat lunch out nearly every day of the week. Leftovers are fantastic for lunch the next day. I suggest investing in a quality lunchbox, ice packs, and thermos. This will make packing and keeping your food cold/hot so much easier. I mean, the average person in the USA spends $3,000 a year on eating out – and that’s just for ONE person! Imagine if you’re a family of five! Here’s the thing, bringing your lunch with you to work, social outings, school, etc., can literally save you THOUSANDS of dollars a year. Start small and start bringing your lunch just three days a week and slowly increase it. Pay attention to how much you spend every week just on lunch out. It’ll make the transition so much easier!

10. Go on a Spending Freeze

If you’ve never done one of these challenges before, they are amazing for showing you where you need to improve. But a spending freeze is where you decide not to spend money on anything other than essentials (so paying bills and buying groceries you can spend on but that Starbucks coffee? Nope.). You do this for a predetermined length of time. So you could do a No Spend Month where you don’t spend money on anything that isn’t essential to your survival for a month. Or you could do a Spending Freeze Week or even just a No Amazon August, where you don’t buy anything on Amazon for the entire month of August. These challenges can be a great way to break up with bad spending habits and start good ones.

11. Stay Organized

Okay, so this one seems a little strange, but the more organized you are, the easier it will be to save money. Why? Because you won’t miss paying a bill on time, incurring a late fee if you miss the due date. And it’ll make tax time so much easier! CPAs charge by the hour typically, and if you do what we accountants call the “shoe box dump,” where you dump a bunch of random receipts on your CPAs desk. That leaves them to figure out what everything is for and categorize it before they can even start on your taxes. That’s costing you a lot of money. Keeping your tax stuff nice and organized will save the CPA time and, in return, save you money.

12. Look for Cheaper Alternatives

I know that saving money can be challenging, but that doesn’t mean you can’t still have fun! Look for free or cheap alternatives to things you enjoy. So instead of buying books off Amazon, first check to see if your library has it! Or look to see if there’s a free little library in your neighborhood. And speaking of the library, most libraries have amazing FREE programs! The more your library gets used, the more funding it typically receives, so start using your library! Many will offer free classes, workshops (I’ve led a few budgeting classes at our local library), to activities for both kids and adults.

Even when it comes to buying essentials – look for a cheaper alternative. My daughter and I both wear glasses, and instead of purchasing them at the eye doctor, we buy them from Zenni and Warby Parker. This saves us hundreds of dollars on prescription eyewear! Especially for my daughter, who has a super high prescription, her lens is typically more than the frames.

Look for money-saving programs like the 4th Grade Pass to the National Parks system, where if you have a 4th grader, they get a free pass to all the National Parks. The point is to get creative and start looking for cheaper or free alternatives to things you already enjoy. Maybe you need a break from the hustle and bustle but can’t swing a weekend getaway. Look into camping as a cheaper alternative! You can do a lot if a little if you’re willing to look.

13. DIY

Sure, there are some things you probably shouldn’t try to do it yourself – like plumbing your entire house if you’ve never plumbed a day in your life. But there are plenty of things that you can YouTube and do yourself to save big bucks! A simple DIY? Instead of paying to wash your car at a car wash, you could do it yourself. Instead of paying a handyman to install your front porch light, you could Google it and do it yourself. The point is, don’t let the fact that you don’t know how to do something be the only reason you don’t even try to learn something new. Be willing to try a little DIY before spending money simply out of convenience.

14. Practice the Sleep On It Method

Here’s the thing: bigger isn’t always better. And sometimes you don’t really need anything. You’re just bored. So practice the “sleep on it method.” Instead of buying something immediately – whether it’s a big or small purchase, sleep on the decision. I do a similar thing with Amazon. I’ll add whatever I feel that I “need” or want to my Amazon cart, and then at the end of the week, I review the cart. And you know what? Most of that stuff I didn’t need at all. I just saw someone on Instagram who had it, and I felt that I was supposed to have it too. So allow yourself to sleep on it before making a purchase.

15. Put Savings on Autopilot

I don’t believe in letting your money be completely on autopilot, as that can get you into trouble. But I do think that putting your retirement and Emergency Fund savings on autopilot can be a great money-saving hack that can help you increase your savings with very little effort. Even if it’s not much, set it up today and start contributing. A little bit adds up. If you need more help getting started saving for retirement using a Roth IRA, head here to this post.

16. Have Good Boundaries

Say what you mean and mean what you say. If you say “no” to something, mean it. If you say “yes” to something, mean it. When you tell your children before going into the store that you’re not buying them anything – mean it. Stand by that statement. Same if you tell someone that you’ll pitch in money for Fourth of July fireworks – mean it. Stand by that statement and contribute. Only you can set and keep good healthy boundaries with your money. And one of the greatest ways I’ve discovered to save money is by sticking to those boundaries. If you don’t set up boundaries around your finances, it will be very easy to watch your money slip through your fingertips.

17. Spending Threshold

If you’re married, one of the things that my husband and I have worked wonders is setting a spending threshold. This is a certain amount of money that, if the purchase exceeds that amount, we must first discuss it with each other. At different stages in our financial journey, the dollar amount has changed. But the point is still the same. So let’s say you and your spouse decide your threshold is $200. That means any purchase over $200 has to be agreed upon by both of you before making the purchase. This has helped us avoid 1) spending money on impulse and 2) being pressured to buy something when it wasn’t really a priority. This is also very helpful if extended family members or friends constantly guilt you into giving them money. You now have the perfect response – “I first have to discuss this with my wife/husband as we both agreed that before we give or spend that kind of money, we both have to agree to it.” Then just as in number 16 above – stick to your boundary. Discuss it with your spouse first.

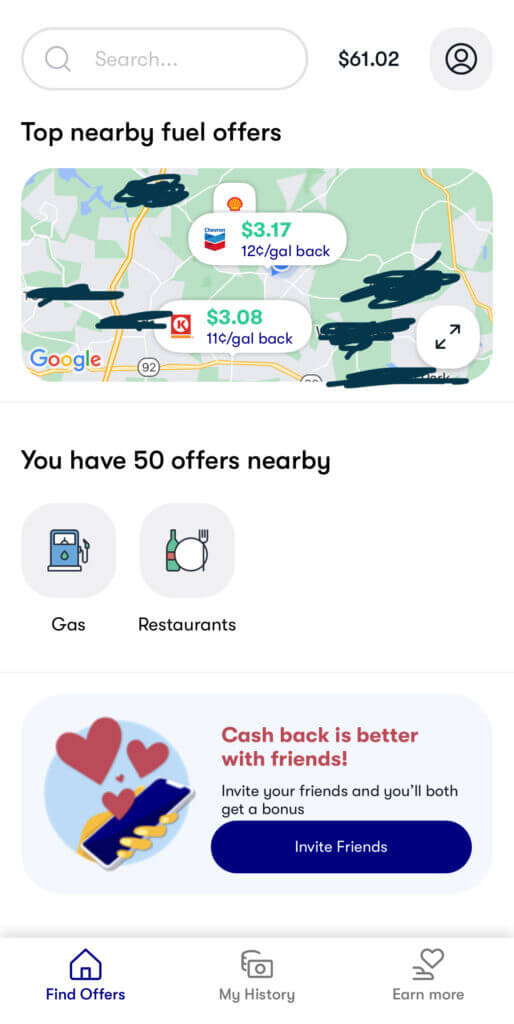

18. Stretch Your Money

Same with using Rakuten or Swagbucks mentioned above, stretch your budget by using apps that help you do that! One of my favorite ways to add money to our budget (and thus increase our savings) is using the Upside app. This app gives you cashback on your fuel purchases. It’s super easy and simple to use! So far this year (2023), I’ve earned over $90 in cashback just by filling up my car! I’ve got over $60 in there, and I’ll be transferring that out later today.

Another great app is Fetch. You scan in your receipts (print or digital), and you can earn points toward gift cards. Now you don’t get actual cash back with Fetch, but you can stretch your budget by getting gift cards for purchases you do need to make.

19. Make Sure You Have Enough Insurance

I know this one isn’t really “money saving” like the others because this one may in fact cost you more money. However, in the end, this one will be worth it! Do you know if you have enough insurance? When we first bought our house, we didn’t pay any attention to our homeowner’s insurance policy. We just signed on the dotted line and sent it to the mortgage broker to get our house. Well, come to find out, that policy was all kinds of wrong.

The total square footage of my home is 2,200, which includes our garage and my husband’s workshop. Our livable space is only 1,400. Guess which square footage was on our insurance policy? Yep. The 1,400. Do you know what that means? That means if a tornado (my house was hit by a tornado a few years before we bought it, so this is completely in the realm of possibility) leveled my home, the insurance company would have only covered rebuilding 1,400 SF of my 2,200 SF home.

Also, the original policy didn’t cover if my septic tank backed up and flooded my home. And guess what happened in October of 2019? Yep, I found myself standing in sewage in my laundry room. So, needless to say, I’m thankful that we caught these errors (there were more) and got ourselves a better policy. Yes, it costs us more than the original policy but has saved us so much. That septic tank backup? That did over $30,000 worth of damage to our home. Insurance didn’t cover everything, but they did cover half of it, so our Emergency Fund only had to pay the other half instead of the full $30,000. So check your insurance to see if they are adequate.

20. Just Stay Home (and Off Your Phone)

And if you’re really serious about saving money, you’ll just stay home and get off your phone! Stay home instead of being tempted to buy while out and about or scrolling Instagram! Put the phone away and instead play board games with your family. Or you can be on your phone as long as you’re talking on the phone to someone you haven’t chatted with in forever. Practice the art of connecting over disconnecting with technology. Your wallet will thank you.

Leave a Reply