If you follow me on Instagram, you probably saw that last weekend, when I pulled my fridge out to clean behind, under, top, and sides of it, I accidentally broke the 44-year-old copper water line to my refrigerator. Oops. 😬 Then followed one of my surge protectors in my house blowing.

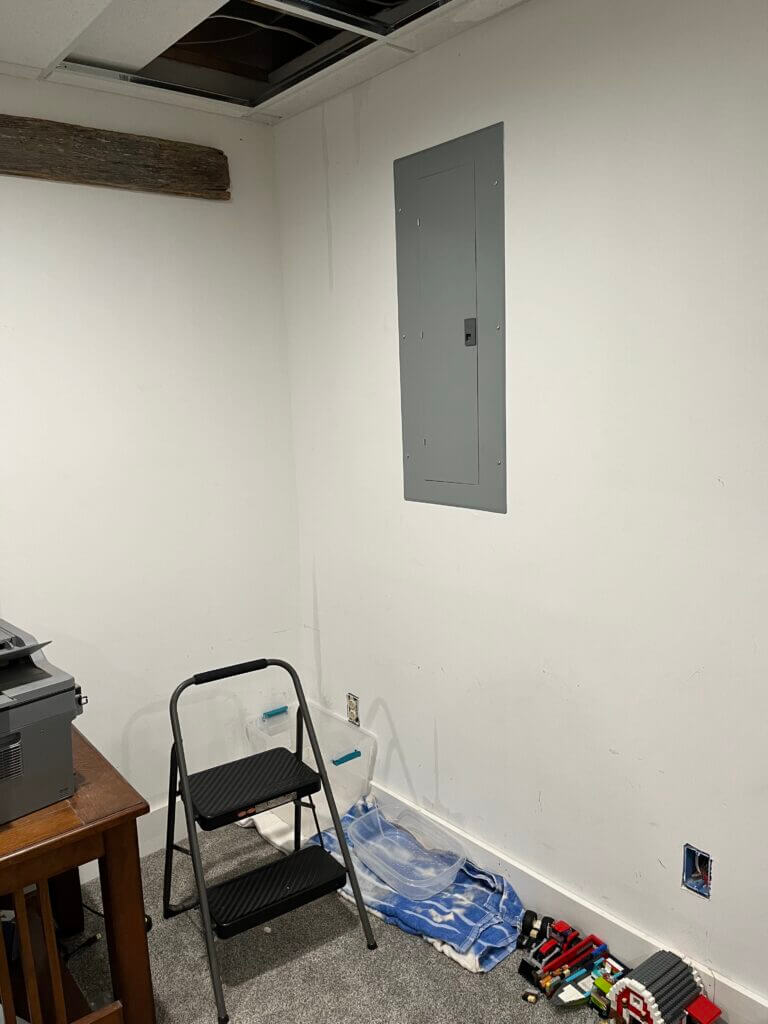

Where my refrigerator line broke, and the water ran down into my finished basement…

Thankfully I caught the water leak before any real damage was done, and the surge protector just required the purchase of a new one. But I’m no stranger to the unexpected. And chances are, if you’re a homeowner, you know how fast those unexpected expenses add up.

So how do you budget for them? I mean, I didn’t exactly plan to break my water line. Heck, I was trying to do my normal quarterly deep clean of my kitchen! I’ve moved that fridge 100 times in the nearly 12 years we’ve lived here. So breaking the water line wasn’t in my “plan.” Nor was it in my budget. So how do we financially plan for those unexpected moments when life jumps up and smacks us right in the face?

1. Have an Emergency Fund

I know this may seem obvious, but if you don’t already have an Emergency Fund in place (a savings account designated to protect you and your family in a moment of crisis), TODAY is the day to set it up. Seriously. Thankfully in my case, my husband is a contractor, and the new water line was less than $30. So it wasn’t a big deal for me to adjust our budget to accommodate that. But when our septic backed up and flooded our finished basement, it did over $30,000 in damage. Yeah, that wasn’t one that I could just quickly adjust the budget to make room for.

None of us know what this year holds. We don’t know when life will hit us like a speeding train. That’s why you’ve got to have an Emergency Fund. (The bank that we use for our Emergency Fund currently has an APY% of 4.05%. You only need $100 to open an account. Head here to check them out.)

2. Plan Ahead

If you know that upcoming huge expenses are coming your way, plan ahead. Set up a Sinking Fund and start putting money – even just $5 – into that Sinking Fund from every paycheck to help save and pay for those expenses. Every year, my husband and I sit down and plan out what household maintenance tasks need to be done in the year and what home projects we’d like to get done. This helps us come up with a number to save up in our Home Sinking Fund. This also makes sure that by 1) keeping up with the maintenance on our home, we don’t end up with another emergency like the septic tank backing up again, and 2) helps us prioritize the projects that we do want to do with our home.

3. Track Your Spending

There’s nothing worse than building up substantial savings and then having to use them due to mismanaging money. Yep. I said it. I know this well because I’ve done it. I’ve had to take money out of our Emergency Fund for non-emergency things because we overspent.

If you’re caught up in a cycle of overspending, it’s time to break that cycle before you wreck your finances. Start right now, tracking all your spending. Write it down in a notebook, the notes app on your phone, a spreadsheet, or a fancy budget planner. It doesn’t matter how or where you record your spending. Just do it. You can’t make changes if you aren’t aware of what’s happening. In order to become aware, you need to track your spending for at least 30 days so you can be aware of the changes that need to be made. Where do you need to cut back? Where are you overspending? What’s the thing triggering you to spend money?

No shame. No guilt. Just information to help you make better decisions.

Leave a Reply