One of the questions that I keep getting from my Commonly Asked Questions post, is “how did you run the numbers to show your husband what your debt-payoff strategy should be?”

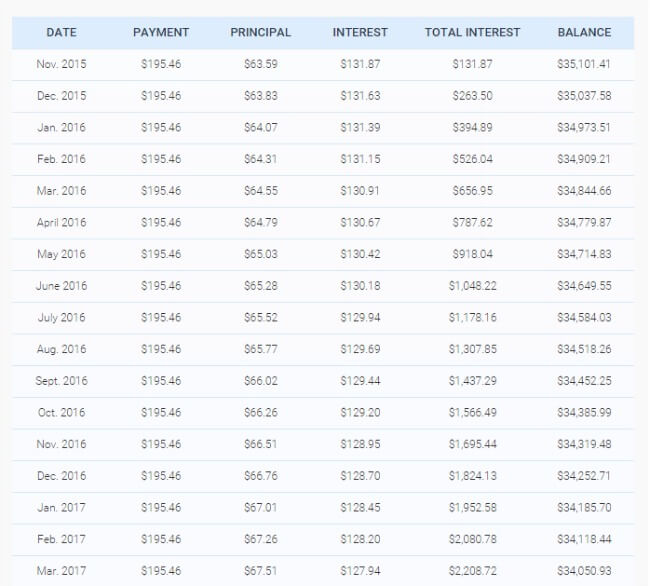

The truth is, I used an amortization table (sometimes referred to as an amortization calculator or schedule). An amortization table shows how much of your monthly payments goes toward principal (the money you borrowed), and how much goes toward interest. It’s a nifty little tool that helps you figure out what your debt-payoff strategy should be.

Now, I didn’t use an amortization table for all of our debt because honestly, an amortization table works best for larger/longer loans – like student loans, car loans, and definitely a mortgage loan.

However, you can still use it for your credit cards and other consumer debt.

Here’s what an example of an amortization table looks like:

How to Use an Amortization Table

I personally have used amortization tables to paint a realistic picture of when we can expect to pay off a certain debt. I can then take this realistic picture and develop our financial goals around it and figure out a plan of attack of:

- How much extra we need to apply to our debt each month in order to reach our financial goals.

- How long it will realistically take us to achieve debt-freedom.

- What our bare minimal payment would have to be every month in order to keep our momentum going (this is my “just in case” strategy because life does happen – sometimes we can’t throw anything extra at the debt monster because we have sick babies to take care of).

How to Set Up an Amortization Table

You can create your own, but I’ll be completely honest with you, it’s not always easy to do. So, if you want to create one quick and easy (and for free), I suggest using a free tool like this one from Bankrate (I’ve used this one several times) to calculate our debt payoff strategies. There are even several Excel templates that you can use as well – just do a Google search!

Some loan companies will actually give you the amortization table with your monthly bill or by request. This is super common with mortgages so if you’re completely lost with this whole idea, just call up your loan company and ask them to send you an amortization schedule of your loan.

Update Often

One thing that really helped us achieve our crazy feat of paying off just over $20,000 of debt this year was that I regularly updated our amortization table when we experienced life changes.

So, when my husband’s doctor inadvertently took all our money and we had to wait several days and weeks before we were fully refunded, I had to update our amortization table because we couldn’t afford to make our extra debt payment that month.

Regularly updating your amortization table will help you keep everything in perspective and will keep you from becoming complacent with your debt payoff strategy.

It’s all about keeping the momentum going!

Have you ever used an amortization table to help you with your debt payoff goals or was there another nifty-little tool that you used?

Oh yay! I’ve been looking for a resource for an amortization table for awhile now, ever since I stopped using Quicken, which has one built in. I agree it is SO HELPFUL — and motivating — to see how even little changes can affect the time it takes to payoff a loan. Can’t wait to start crunching some numbers! 🙂

I had no idea that Quicken had one! That’s pretty awesome. 🙂 I really like using the Bankrate one only because creating one is super time consuming in my opinion.

We get one with our mortgage and home equity loan statements, so I’m familiar with what they look like, but I’ve never used it as a tool. I want to pay off our remaining car loan in 2016, so this will be a very helpful way to plan those payments out – thank you!

I hope you and Charlotte are doing well!

Thank you so much Amy! I totally forgot how sleep-deprived and messy the newborn stage is! lol Thankfully, my hubs took the week off from work to help me out – it’s been a true blessing! 🙂

I never thought about using an amortization schedule for anything else besides a mortgage! I could totally use it on my student loan repayments and update it as I go to see how far off I am from debt freedom. This is great! Thanks for sharing a new tool I’m now going to take up 😀

You’re so welcome Jaymee! 🙂

This was an invaluable tool that helped us pay off our mortgage, which we did 6 months ago, 5 years early. It’s actually fun and exciting to see that principal shrinking each month!