I absolutely loved our 21 Days to a Better Budget series and I hope y’all did too! I cannot thank the amazing bloggers that helped to make this series possible enough! In case you missed that series, you can check out all the fabulous posts here.

Another exciting development is… I was invited by Dave Ramsey’s team to attend Christy Wright’s Business Boutique Conference in November! I seriously cannot believe it and I’m super excited to meet Dave’s team that I’ve been working with for about a year in person….and I’m kinda hoping that I’ll get to meet good Ol’Uncle Dave as well…but we’ll see! Are you attending the conference? If so, I’d love to meet you there!

Blogging

FinCon. Let’s talk. Y’all know that I was scared straight about attending my first conference and especially freaked out about speaking at said conference. So, how did I do? Well, I didn’t pass out. 😉 According to several folks that were way too kind to me, I did great. But I have to praise the other members of my discussion panel because we ROCKED it y’all.

FinCon will be in San Diego, CA (said in my best Ron Burgundy voice) next year, so make sure you plan on attending because I plan to be there and I’d love to meet you! That was by far my favorite part of the conference – getting to meet and hug in real life the bloggers that I’ve been following. Like Kalyn of Creative Savings, Rosemarie of The Busy Budgeter, Cat of Budget Blonde, Natalie of Financegirl, Pat Flynn of Smart Passive Income (make sure you listen to his podcast if you don’t already), Joe Saul-Sehy of Stacking Benjamins and the list goes on.

Okay, so my income numbers are not super impressive this month because, well, I had a lot of expenses – hotel, travel, and I finally switched email providers.

MailChimp has been great but my list has grown enough to where it is no longer working for me. I’ve been having several issues with my emails landing in subscribers spam folders, my automation emails not sending (like the one for my Debt-Free Christmas Challenge), and it has just been a super big pain. So, I finally switched to ConvertKit* and I’ll let y’all know how much I like/don’t like it. So, far I’m loving the fact that ConvertKit will switch everything over for me for FREE and they’ve been super helpful and have answered all my questions promptly.

My total income after expenses was….$1,258.56!

If you’re interested in how I work my affiliate sales, you can sign up here to grab my free Affiliate Marketing eBook!

| INCOME | |

|---|---|

| AdSense | $574.84 |

| Affiliate Sales | $769.47 |

| Book Sales | $171.09 |

| Media.Net | $184.05 |

| Speaking Fee | $263.44 |

| YL | $130.86 |

| Freelance | $25.00 |

| Total: | $2,118.75 |

| EXPENSES | |

|---|---|

| eJunkie | $5.00 |

| BoardBooster | $10.00 |

| Advertising | $30.00 |

| Travel/Lodging | $476.22 |

| FinCon16 Pass | $163.97 |

| ConvertKit | $99.00 |

| Canva | $1.00 |

| MailChimp | $75.00 |

| Total: | $860.19 |

Here are my blogging goals specifics:

Finish creating my pinning schedule and strategy.( I learned a ton of amazing information about Pinterest from The Busy Budgeter and from Bob of Christian Personal Finance while at FinCon and after implementing their strategies, I’m already seeing a great spike in traffic! Oh and if you aren’t already using Boardbooster to schedule your pins, you should be. You really can’t beat $5 a month to save your sanity and you can sign up here for a FREE trial! )- Create my Facebook sharing strategy. (I’m still working my way through Amy Porterfield’s Jumpstart Your Facebook Marketing Strategy, but I’ve learned so much about FB already. It’s changing the way I work with FB ads and is helping me garner more engagement from my fan page. )

Keep pageviews at 200,000 and increase to 500,000 by the end of the year. (You can read how I more than doubled my pageviews here.)(My pvs in September were: 265,225.)Professional blog design. (Currently working with Pixel Me Designs)(Done)Find three brands to establish a working relationship with for underwritten posts.(Done!)Complete media kit by April 1st.(Done)Complete Business Plan by April 30th.(Done)Finish my next book by my birthday (March 29th) and publish by June on Amazon.(Done – Grab it here.*)Increase my minimum writing goal from 500 words per post to 700 words per post.(Done.)Keep editorial calendar with at least two weeks months of posts, written and scheduled & a month out with planned posts.(So, far so good. Here’s to hoping that I keep this up in October! )Attend one blog conference.(Done.)Research and implement better SEO tactics and improve search engine traffic on my site.(Done…for now. 🙂 )- Bring Alexa Global rating below 100,000 and U.S. rating below 15,000. (Both my Global and US rankings went up thankfully! Global is currently: 182,800 and U.S. is currently: 38,877)

Personal

Real quick y’all, I have to give a shout out to my amazing husband. Even though he can make me completely and totally crazy, he’s amazing. His support during this difficult time of losing my Daddy has been incredible and I’m so very thankful that God gave him to me as my husband.

For my Daddy’s memorial, we wrote messages on 57 balloons (my Daddy’s age) and “sent them to heaven”. It was a beautiful scene as our family and my Daddy’s lifelong friends all said their goodbyes.

Here are my personal goals specifics:

- Begin working out using the Tupler Technique to fix my diastasis. (I am following the workouts in Lose Your Mummy Tummy *) (I have had to stop doing these but I’m going to leave this on the list as I plan to pick it back up after I have Charlotte.)

Work out three times a week for ten to fifteen minutes and then increase length of workouts to thirty minutes to an hour and to simultaneously increase the intensity.(Changed to the goal below)Spend 30 minutes every day in active play with the boys (walking the neighborhood, playing hide-n-seek, “monster”, or other games they want to play).(We’ve been playing Legos like crazy. The boys love building Mommy a castle to live in….and then they promptly tell me that no girls are allowed. )- Write in gratitude journal every day. (I am using Money Saving Mom’s gratitude journal, Choose Gratitude * – amazing!) (Sadly, I fell a little behind on this one this month. )

- Read daily Bible reading and journal about the scriptures read every day. (I struggled getting this done this month, but I’m working on giving myself grace, because it was a crazy busy month!)

- Schedule a paid date night and paid family night/event once a quarter. (We’ve been planning my 30th birthday vacation for next year, so now that we have that budget in place we’re working on figuring a date night for after Charlotte arrives.)

- Increase daily water intake to full eight glasses of water a day and continue detox regimen with lemon essential oil. (Totally fell off the wagon with this one this month…)

Spend thirty minutes to one hour two times a week working with Conner on preschool learning activities. Spend same time working with Collin on tot school activities.(We’ve actually been doing a lot of curriculum that correlates to what the boys are learning in preschool from our homeschool preschool curriculum that we developed earlier this year. So, far the boys love doing it!)Drastically reduce the amount of personal time spent on Facebook, by leaving groups and un-liking pages that just clog up my newsfeed. Use the News Feed Eradicator extension for Chrome to keep me from being sucked into Facebook’s “should-have-left-it-in-high-school” drama.(Made this one happen consistently!)

Financial

PMI.

Know what it is?

In case you don’t, it’s Private Mortgage Insurance that is required on all FHA mortgages….in other words since we bought a foreclosure, we have to pay an additional $60 a month in PMI until we have paid at least 20% of the principle of the loan and have had our FHA mortgage for at least 5 years.

Here’s what stinks about it….we’ve more than paid off 20% of our mortgage, but we haven’t reached the 5 year mark. We’ll reach the 5 year mark in June of next year….which means we can do one of two things….we can either refinance our mortgage which will cost us roughly an additional $5,000 or we can just wait until June of 2016 and keep paying the additional $60 a month.

We’re waiting because an extra $60 a month will only be $540 spent versus $5,000, but I share this information with you in case you weren’t aware that PMI exists and are on the debt-free journey too.

Here are our financial specifics:

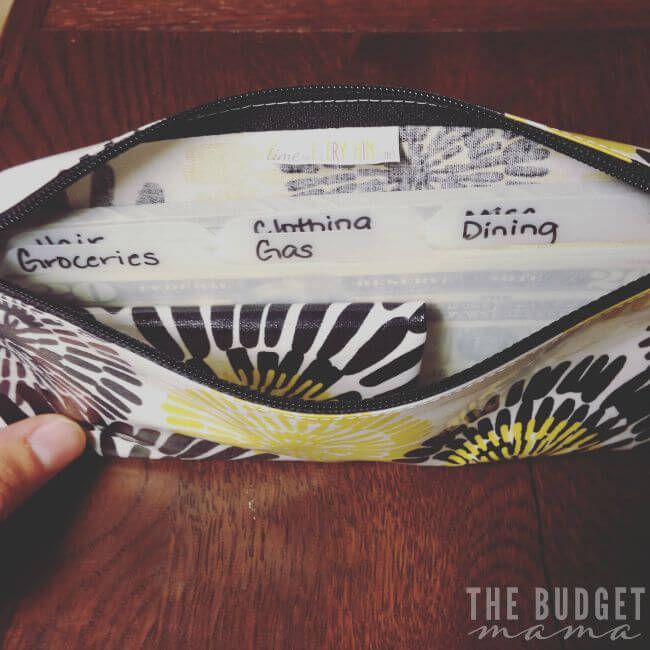

Pay off student loans by December 31st. Total balance at the beginning of the year: $20,106.81(DONE!!!!!!!! )Contribute the max allowed percentage to hubs’ 401(k) plan and continue contributing $30 a week to my Roth IRA. Will increase my contribution amount if goal of paying off student loans is met before the end of the year. We will be decreasing the amount contributed to our emergency fundin order to build up our retirement funds.(Done.)- Go back to carrying cash only for all purchases. (We’re doing pretty great with this and in case you don’t get my email newsletter, I’m challenging all my readers to switch to cash only for October….yep, the entire month of October I want you to spend only cash – no debit and no credit. Let’s do this! 🙂 You can find out more here. or watch the video here. )

Here’s my cash wallet (handmade by the amazing Melissa of A Time for Everything!)

- Plan and implement a spending freeze. (Ruth Soukup’s book, 31 Days to Living Well and Spending Zero* arrived at my door for me to review and it was the perfect book to literally throw at my husband on this. (yes, I totally did throw it at him….I may have just been a little crazy hormonal pregnant…or just crazy) He’s agreed to do it but he hasn’t given me a date……so we’ll see.)

Set aside $10 every week towards our Christmas fund for a debt-free Christmas (it will be our third one!).(Done! We have enough Swagbucks* earnings to pay for Christmas this year).- Complete Financial Peace University by December 31st. (Geez. We are doing so bad with this! We haven’t done this at all this month…..ugh.)

Reading List

I didn’t get much reading done this month unfortunately, but I did score some awesome FREE books while at FinCon (even one by Mr. Jeff Goins), so I’m looking forward to diving into those soon! 🙂

Balanced: Finding Center as a Work-at-Home Mom * by Tricia Goyer – I needed this book this past month. Tricia has been a WAHM for 20 years and has a wealth of insight when it comes to managing your time, workload, and most importantly your home.

31 Days of Living Well and Spending Zero* by Ruth Soukup – Really, this is a great book and if you’ve done a spending freeze before you know just how hard it can be. I love that Ruth gives so many amazing ideas and suggestions for not only surviving during your spending freeze, but also thriving.

Have you grabbed my new book, Real Life on a Budget yet? If not you can grab it here. 🙂

What big accomplishments have you mastered so far this year? Share them below – I’d love to cheer you on!

STANDARD DISCLOSURE: In order for me to support my blogging activities, I may receive monetary compensation or other types of remuneration for my endorsement, recommendation, testimonial and/or link to any products or services from this blog. Affiliate links will have an asterisk (*) next to them. {Read my full disclosure policy here.}

Hey thanks for the shout out! It was great to see you at FinCon. You are totally killing your goals, so that’s awesome. Hubs and I have done fairly well with our goals so far this year, so we’ll see how the last part of the year goes and hopefully we’ll be able to cross a lot of things off our list too.

I loved getting to meet you in person Cat! 🙂 I have a feeling once baby 3 comes, it’ll be a bit more of a challenge for us to get some things crossed off our list…. I can’t wait to hear how you do on your goals! 🙂

I am SO going to FinCon next year! I live in San Diego so that’s convenient! After seeing your posts and Rosemarie talk about it at The Busy Budgeter I decided that’s where I need to be! PS How exciting to be working so closely with Dave Ramsey’s team! Congratulations!!! ?

Thank you so much Brittany and I can’t wait to see you there! It was definitely an awesome time! 🙂

Sending baloons to heaven is such a sweet idea!

Great goals update, would love to have you link this up to my #GratitudeGoals linky.

Jessi! You are rocking it! I am sorry again to hear about your loss with your Dad. I am sure he is so proud of what you are accomplishing. It was so fun meeting you at FinCon and I look forward to learning from even more this year and seeing you again in San Diego. Blessings on you, your family and hoping to meet little Charlotte soon!

Thank you so much Aja! 🙂 I absolutely loved getting to meet you in “real life” at FinCon – you’re just as sweet as I thought you’d be! 🙂

I am so excited to see you rock your goals! It was so wonderful seeing you in person and I can’t wait to meet Charlotte. Sending you happy thoughts 🙂

Thank you so much Michelle! I keep hoping this stubborn little girl will show up soon…fingers crossed! 🙂

Hi Jessi! Just finding your blog thru the money making mom, love yous story! My husband and I are on the Dave Ramsey train. ! year under our belts and prob another 2 -2 1/2 . I think I may have recently also saw your name in Catholic blogger’s group too? Maybe I’m making that up?! Anyway looking forward to following and learning form your tips:)

Thank you so much Patty for your encouragement and I am in a Catholic Bloggers FB Group! 🙂 I love how small the world really is. Congratulations on being on the Dave Ramsey train and already having year under your belts! That’s a awesome accomplishment! 🙂

I like your blog.

Thank you so much Kathy! 🙂

Congratulations on your continued great progress toward your goals! Paying off you student loans and having enough saved for Christmas in early October are impressive accomplishments!

We did’t put 20% down when we purchased our house, so we were stuck with PMI for a couple of years. However, when we refinanced our mortgage a couple of years ago, the appraised value of our home when up, so we were able to kick PMI to the curb AND decrease our interest rate. Both were much appreciated!

Thank you so much Amy! I can’t wait to no longer see PMI on our mortgage and hopefully we can meet our next big payoff goal! 🙂

It was so great to meet you in person, Jessi! You are amazing! I love your income reports, too. I need so much to get my affiliate $ and ad $ up — my traffic is there; I don’t get it!

Awe, you’re so sweet Natalie! I can’t wait to see you again! Affiliates – my key takeaway is to only promote what you use and to write posts/emails around that product/service. If you truly love it, it will resonate with others and they will be willing to try it! 🙂

You might be able to tell from my comments that I’ve been binge reading your blog the last few days. 🙂 This is by far one of the best personal/family finance + biz planning posts I have seen. THANK YOU! So many great tools and tips and ideas to check out!

Thank you Malea! 🙂