This post is part of our 21 Days to a Better Budget Series and was written by the 100% Debt-Free A.J. of Principles of Increase! To view all the posts in our series, please click here.

Are you looking for the best way to manage your budget? There are so many methods that range from Pinterest printables to apps and desktop software. But how do you choose the best one? If you are looking at ditching the pen and paper to go digital, Google Apps might be a good place to start. Huh? I thought that was for productivity and businesses. Read on, my friend.

A little about me: I am a self-professed software nerd. My dad was an early adopter of computers and that same spirit has found its way into my personal and professional persona. By day I create and maintain databases and by night my alter ego as America’s Financial Sweetheart reigns. Simply put: I like helping people find better ways to manage and grow their finances. This often means recommending apps to facilitate this process. If people are not sure about what might be the best way to manage budgeting, I recommend starting with a Google Apps sheet. Why? Well, having implemented more than a few large-scale databases I know that it helps to start off a bit more slowly and manually so that when you are ready for automation you know what you need and you can detect problems right away. The same goes for personal finance software. I like to make sure people understand the math and methods behind the apps that will be handling their finances before diving in full speed.

Having used Google Apps myself to manage our budget, here are helpful tips on setting up your spreadsheet layout:

- In order to access Google Apps, you will need a Gmail email account. Sign-up for one here.

- Once you’re signed up, navigate to your Google Drive (use the small 3 by 3 grid icon in the upper left of your email account page) and create a Google sheet.

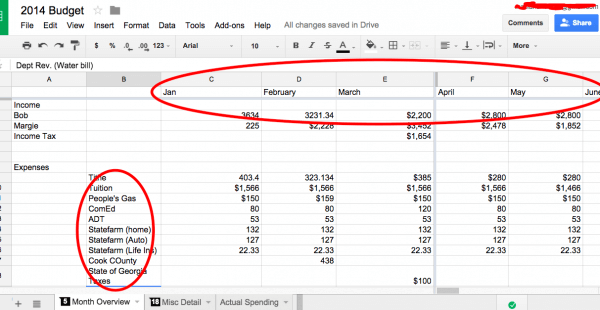

- Use rows to create budget categories and columns for each month.

- You can place income sources at the top of the sheet, then reference those cells in your net earnings calculation toward the bottom of your expenses columns. You will want to total all your expenses and subtract them from your total monthly income to make sure you are cash flow positive for the month. If you are not, then the budget must be adjusted! If you need help with formulas and layout, here is a tutorial to help with more technical steps.

- Once payday hits, pay bills according to the budget you set up and take what’s left over for the rest of your categories (groceries, entertainment, clothing, etc.) from the bank in cash. You will use this cash for your envelope system (you are using the envelope system right?)

- Cool tip: you can share your sheet with anyone via email! When we were doing this, I would share it with my husband for our budget meetings.

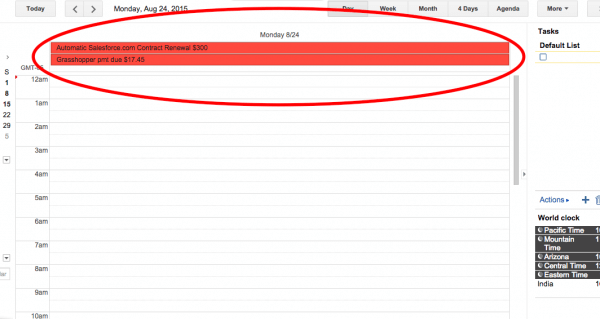

- Added bonus: Google Apps includes a calendar feature. I use this to help schedule bills and notify me when they are due. Simply go to your Google calendar app and create recurring events on the dates your bills are due. In the subject line of the event record, I like to put the name of the company I owe and the estimated amount, so I can see clearly what’s due and when. In the notes, I add a link to the website for payment. At the bottom of the event I create a few reminders (notifications). Sometimes, I’ll create an email reminder 5 days before it’s due, then a pop-up reminder on the day it’s due to make I don’t miss anything. You can even color-code them so all your bill due dates show up as one color on your computer, tablet or phone. Pretty neat, right?

If after a few months, you find that you need more robust features like bank integration on or online bill pay, then by all means upgrade away! But in the mean time, Google sheets is a great place to start. Happy budgeting!

—

A.J. is a mom, wife and business owner who writes about family, finance, faith and entrepreneurship at www.principlesofincrease.com. She is passionate about helping others get out of debt and find creative ways to experience financial freedom. You can read more about A.J. here.

A.J. is a mom, wife and business owner who writes about family, finance, faith and entrepreneurship at www.principlesofincrease.com. She is passionate about helping others get out of debt and find creative ways to experience financial freedom. You can read more about A.J. here.

I love using Google Sheets for my budget! I also love using the app on my phone so if I’m out and have to spend some money, I can change the file right there.